Since our acquisition of Carnelian Capital last year, we have been busy integrating the two teams and looking at the best practices of both firms. Carnelian have a monthly client e-newsletter, which we feel will be a great addition to our communications and blogs which we drive through the website.

The newsletter is based on the concept of Marginal Gains; the principle of making little improvements (the classic figure is 1%) in various aspects of a process which, taken as a whole, results in a very significant improvement overall. Consequently, please find our first edition; four articles to provide concise (sometimes technical) summaries of issues and opportunities across a wide range of financial planning topics and themes.

Jonathan Howard, CEO Richmond House Wealth Management

The Spring Budget has Sprung and had a few surprises in there to keep everyone on their toes. The main key changes are around pensions and will give some real freedom to those that have snuck over the Lifetime Allowance.

As ever we are here to answer any questions you may have. The end of the tax year is upon us so don’t leave it too late if you have any last minute planning!

Chancellor of the Exchequer, Jeremy Hunt, delivered his first Spring Budget on 15 March declaring it was “A Budget for Growth.” The fiscal update included a range of new measures, some of which had been widely trailed prior to Budget day, in order to achieve growth “by removing obstacles that stop businesses investing; by tackling labour shortages that stop them recruiting; by breaking down barriers that stop people working; and by harnessing British ingenuity to make us a science and technology superpower.”

OBR forecasts

The Chancellor began his statement by unveiling the latest economic projections produced by the Office for Budget Responsibility (OBR) which he said showed the UK would meet the Prime Minister’s priorities to “halve inflation, reduce debt and get the economy growing.” In relation to the first priority, Mr Hunt said the latest OBR figures suggest inflation will fall from an average rate of 10.7% in the final quarter of last year to 2.9% by the end of 2023. This sharp decline is partly due to some of the Chancellor’s Budget measures, including the three-month extension to the household Energy Price Guarantee (EPG), which the government had confirmed earlier in the day.

Mr Hunt also said the OBR forecast suggests the UK economy will now avoid a technical recession this year (defined as two consecutive quarters of economic decline) and then expand in each of the remaining years of the five-year forecast period. According to the updated figures, the economy is expected to shrink by 0.2% this year, a significant upgrade from last autumn’s forecast of a 1.4% contraction, with growth then predicted to hit 1.8% in 2024 and 2.5% in 2025, before easing back towards its medium-term potential growth rate of 1.75% by 2028.

The Chancellor’s growth strategy focuses on the four pillars ‘Everywhere, Enterprise, Employment and Education,’ as previously outlined in his Bloomberg speech in January.

Everywhere

Mr Hunt spoke about the government’s plans for ‘Levelling Up,’ including the launch of 12 new Investment Zones. Across these “12 potential Canary Wharfs,” £80m of support per zone will be available for skills, infrastructure and tax reliefs. Mr Hunt also mentioned specific projects selected for local investment, including:

Enterprise

To provide the right conditions for businesses to succeed:

Employment

The Chancellor turned next to Employment, with a suite of new measures to “remove the barriers that stop people who want to from working.” To achieve this, he announced:

Mature workers

People with long-term illnesses and disabilities

Welfare recipients

Care leavers

Education

Mr Hunt then turned to Education, stating that he wants to reform the childcare system, currently “one of the most expensive systems in the world.”

His new proposal will offer 30 free hours of childcare each week to pre-school-age children aged nine months or above in English households where both parents work. It will be phased in on the following timeline:

Also, schools and local authorities will be funded to increase availability of wraparound care, to enable parents of school-age children to drop them off between 8am and 6pm.

To tackle the problem of unaffordable upfront costs, Mr Hunt also announced support for the 700,000 families on Universal Credit. Another major change involves each staff member in England being able to look after five two-year-olds instead of four, as is already the case in Scotland.

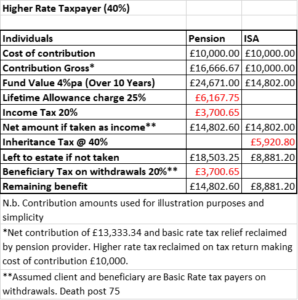

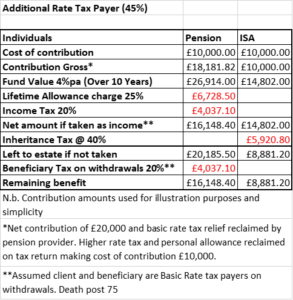

Personal Taxation and Pensions

To encourage over-50s to extend their working lives, the government is increasing tax relief limits on pension contributions and pots – the Annual Allowance will be raised from £40,000 to £60,000 from April 2023; the Lifetime Allowance (LTA) charge will be removed from April 2023, and the LTA will be abolished from April 2024. The maximum amount that can be accessed tax free (Pension Commencement Lump Sum) will be frozen at its current level of £268,275 (25% of current LTA). From April, the minimum Tapered Annual Allowance (TAA) and the Money Purchase Annual Allowance (MPAA) will increase from £4,000 to £10,000 and the adjusted income threshold for the TAA will also rise, from £240,000 to £260,000.

As a reminder, the following changes were previously announced in the Autumn Statement 2022:

In addition:

Other key points

Closing comments

Jeremy Hunt signed off his announcement saying, “Today we build for the future with inflation down, debt falling and growth up. The declinists are wrong and the optimists are right. We stick to the plan because the plan is working.”

As the year is upon us it has become apparent that the changes in the budget are fast approaching and need some consideration. The end of the tax year will be here before we know it and one article makes reference to this, while another looks at investment options, which are becoming more important due to the budget changes. Whilst looking at the right investment wrapper it is also important to look at global opportunities and the right tax wrapper so hopefully this month’s edition gives you a flavour of all the areas we can look at for your portfolio.

By any comparison, the past 12 months have been tough for investors with a series of shocks impacting markets and, as 2023 dawns, uncertainties remain. One constant on the investment horizon, though, is the requirement to be strategic with your portfolio. A sound strategy based on careful planning; making purposeful decisions, based on thorough research and reliable processes, will stand you in good stead.

Last year saw markets struggle with bouts of volatility as a combination of high inflation, rising interest rates and the war in Ukraine brought about challenging headwinds and markets sought a stable footing. As a result, fund inflows slowed while cash as a percentage of investors’ portfolios rose, prompting warnings that investors need to be aware of limitations to the Financial Services Compensation Scheme (FSCS) for cash balances.

Identifying opportunities

With large amounts of money on the sidelines, using our knowledge, we aim to identify opportunities and position portfolios to benefit from recession-resistant companies in which we have conviction. Those who still have the capacity to invest should consider adding back to their portfolios in order to take advantage of any potential low valuations.

Battling inflation

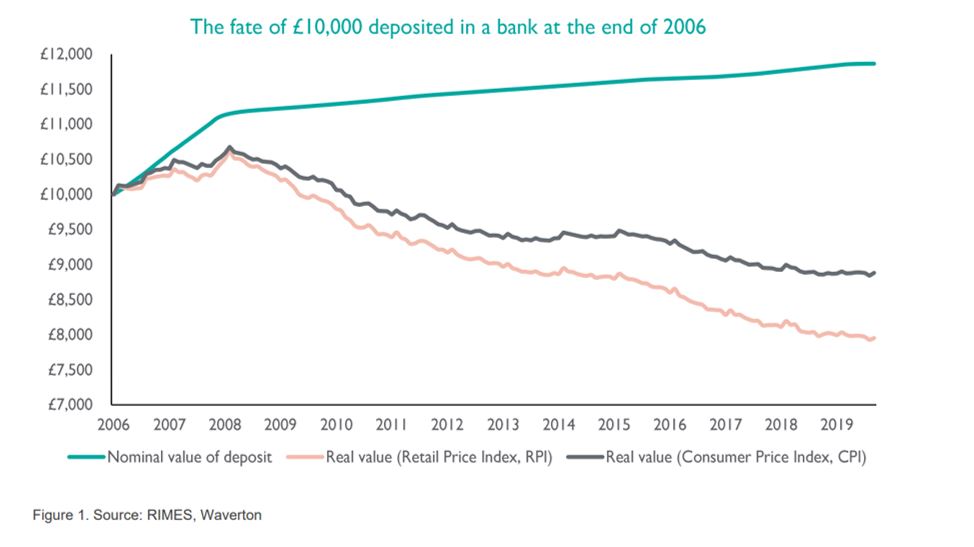

Investors also need to be aware of the erosive impact of inflation on cash-based savings. In the current economic climate, anyone holding a significant proportion of their assets in cash, even with savings rates improving, will inevitably see the value of their wealth decline in real terms. In essence, equities offer a better potential defence in the battle with inflation.

Trust in our process

Experienced investor or not, staying calm during periods of market turmoil is never easy but adapting your mindset and focusing on investment strategy rather than market sentiment is vital. Investing in the stock market does clearly involve a level of risk but the adoption of a carefully considered strategy based on sound financial planning principles undoubtedly offers investors the best chance of success.

As the end of the tax year approaches, a prime consideration should be how external factors such as reduced or frozen allowances, together with high inflation, could impact your finances and what action you need to take before 5 April 2023.

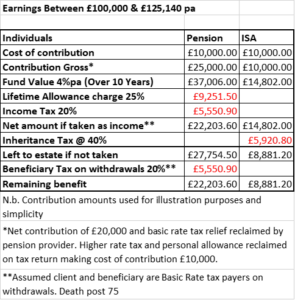

If you are affected by the impending changes to Dividend Tax or Capital Gains Tax (CGT) announced in the Autumn Statement, have you considered investing up to £20,000 this tax year in a stocks and shares Individual Savings Account (ISA)? From April 2023, the Dividend Allowance will be cut from £2,000 to £1,000 and then fall further to £500 from April 2024. In addition, the annual CGT exemption will fall from £12,300 to £6,000 next year and then to £3,000 the following year. Dividends received on shares within an ISA are tax free and won’t impact your Dividend Allowance. Also, any profit you make when selling investments in your stocks and shares ISA is free of CGT.

And don’t forget your pension

Both the Annual Allowance and Lifetime Allowance are frozen, at £40,000 and £1,073,100 respectively. As these allowances haven’t increased with inflation, it effectively means those saving to the maximum extent possible with tax concessions can save less in real terms each year.

The International Monetary Fund (IMF)1 has predicted a challenging 2023, reducing growth expectations and forecasting economic contraction in a third of the world, in its latest World Economic Outlook entitled ‘Countering the Cost-of-Living Crisis.’

With the cost-of-living crisis ‘tightening financial conditions in most regions’, the outlook suggests that in order to restore price stability, monetary policy should stay the course and fiscal policy should aim to alleviate pressures ‘while maintaining a sufficiently tight stance.’

The global growth rate for 2023 has been revised down from previous expectations to 2.7%. This reflects ‘significant slowdowns’ for the largest economies as America’s gross domestic product (GDP) contracted in the first half of 2022, followed by the Euro area’s contraction in the second half of last year, and prolonged COVID-19 outbreaks and lockdowns in China. Closer to home, the IMF predict growth of 3.6% in 2022 and 0.3% in 2023 for the UK.

1IMF, 2022

According to the latest Dividend Monitor2, driven by sterling weakness, 2022 headline payouts are expected to rise to £97.4bn, up 11.0% on an adjusted basis, with underlying dividends expected to rise 13.4% to £87.2bn. The provisional forecast for UK dividends in 2023 anticipates a slight drop in headline dividends but modest underlying growth.

Looking ahead, Ian Stokes, Managing Director of Corporate Markets UK and Europe at Link Group commented, “For 2023, we expect a further reduction in mining dividends and likely lower one-off special dividends but outside the mining sector there is still room for payouts to rise, even with a weakening economy. Our provisional 2023 forecast suggests a slight drop in headline dividends to £96bn and a slight increase in the underlying total to £89bn. This implies no change in our expectation that UK payouts will only regain their pre-pandemic highs some time in 2025.”

2Link Group, 2022

Author: Richmond House

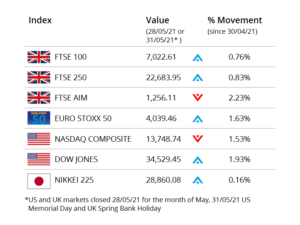

This year has certainly flown by and not without incident – the war in Ukraine, inflation and cost-of- living impacts, not to mention the ‘Liz Truss Effect’ on the markets. We are starting to see some green shoots in markets and alternative solutions, where historic plans have fallen. There has been some recovery in the FTSE 100 following the mini budget but there are many variables to consider over the coming year. I enclose a market summary to keep you up to date with our investment team, Bordier’s opinion and an article from John Merrifield on our new sponsorship of a local charity.

Wendy Devlin DipCii, CEFA, CeMAP (MP and ER)

Head of Advisory Services

wdevlin@richmondhousewm.co.uk

Market overview

After a strong October, developed market equities continued to rally in November, rising a further 7%. The main catalyst was the greater than expected fall in US inflation (down from over 8% to 7.7%), which led the market to believe that inflation in the US may have peaked and that the US Federal Reserve may be able to slow, and potentially end, the cycle of rate rises earlier than anticipated. Evidence continues to suggest that supply chain disruption globally is alleviating. Within the US, falling prices in areas such as goods and autos were key drivers in this fall in inflation although the picture does remain mixed; inflation in areas such as services remains more stubborn.

In contrast to the US, inflation numbers coming out of the eurozone and UK hit new highs as rising food and energy prices continued to impact. Economic data in both regions improved slightly from very depressed levels. However, the outlook remains weak. In the UK, the Office for Budget Responsibility (OBR) issued forecasts for a 1.5% decline in GDP for next year and for a 7% fall in real (i.e. relative to inflation) incomes. There was brighter news in terms of the energy crisis in Europe, where a combination of mild weather and good progress in securing new and alternative supplies of gas, have led to storage levels for the winter being almost fully replenished.

Emerging market equities rallied even more strongly than developed indices in November, rising close to 15%. Sentiment was buoyed by a modest relaxation in Covid restrictions in China and the anticipation of potential further loosening of restrictions. Economic data in China was relatively weak, pointing to a continued economic slowdown that has prompted authorities to ease policy and provide some targeted support measures, which has also been well received by markets.

November saw further 75 basis point rate hikes in the UK and US, taking rates to 3% and 4% respectively. Despite this, the less hawkish sentiment that perpetuated over the month drove global bonds up nearly 5%.

The recent recovery of sterling has continued as a level of calm has returned to UK politics and financial markets.

Strategy positioning

All strategies continue to remain towards the upper end of their corresponding Dynamic Planner risk profile. Equities are our preferred asset class and we are maintaining a full exposure across all strategies. Our expectation of modest but positive global economic growth over the next two to three years, the resilience to-date of corporate earnings and undemanding valuations, provide a supportive background for risk assets in our view.

Our equity exposure is targeted to areas and sectors that should provide superior levels of growth and to areas that should prove resilient to any periods of poor market sentiment. This points us towards the US and Asia, and to sectors such as global infrastructure and renewable energy.

In addition to equities, attractive opportunities have also appeared in both government and corporate bonds and, after a tumultuous period of returns so far this year, we expect a more ‘normal’ return profile from fixed interest assets going forward.

As ever, we remain very mindful of downside risks and are retaining exposure to low risk, uncorrelated strategies in the alternatives space that have provided excellent diversification benefits so far this year.

We are delighted to announce that Richmond House Wealth Management has become a corporate partner for this local Hertfordshire charity. We have supported them in previous years by way of donations at Christmas and have seen the great work they do for those in need, particularly in Stevenage and Hitchin.

I first met Shane Cole (CEO of Feed up Warm up) three years ago and became inspired by his determination to help others. It was a cold winter in 2018 when Shane Cole founded Feed Up Warm Up, driven by personal knowledge of how homelessness feels. When Shane was 17 and had just left foster care, he found himself on the streets over Christmas.

Using this experience, and his background in catering, he rallied the community to open a drop-in centre for Hitchin’s homeless. Five months later, he was asked to open a second much-needed centre in Stevenage.

Today they operate a drop-in centre once a week at Stevenage football stadium and at Our Lady Immaculate Church in Hitchin. Not only can the guests get a cooked meal and warm clothing, but also someone to talk to, sing a song or get a haircut. This really does make a difference to those affected; unfortunately, the numbers are on the increase given the current economic situation.

I hope that we can help this charity grow over the next few years and achieve their aim of opening a 24/7 drop-in centre. In 2023, we also aim to help them with volunteering days as well as fund raising.

To find out more about this charity please visit www.feedupwarmup.co.uk . Or on Facebook or Instagram.

Author: John Merrifield, Chartered Financial Planner

jmerrifield@richmondhousewm.co.uk

As you all know by now the budget has been announced and it covered a bit more than expected, triple lock is here to stay and tax freezes mean tax cuts for most. This month’s Marginal Gain is a summary of the budget so you can see it in bite sized chunks and in an easy read format.

“We will face into the storm”

On 17 November, Chancellor of the Exchequer Jeremy Hunt delivered his fiscal plan to “tackle the cost-of-living crisis and rebuild our economy” stating that the government’s three priorities are “stability, growth and public services.” The Chancellor struck a defiant tone during the key fiscal event, saying he was “taking difficult decisions” that would deliver a “balanced path to stability” before outlining a package of measures equating to a consolidated total of around £55bn in spending cuts and tax rises.

Economic forecasts

Mr Hunt began his statement by stressing that the country is facing “unprecedented global headwinds” before unveiling updated economic projections from the Office for Budget Responsibility (OBR) which confirm the UK is now officially in recession. The Chancellor did, however, point out that the independent public finance analyst believes the downturn will be relatively shallow, if comparatively long. The revised GDP figures suggest the UK economy will grow by 4.2% this year, but then shrink by 1.4% next year before returning to growth in 2024.

The Chancellor also announced revised OBR forecasts which suggest inflation will peak in the current quarter and then drop sharply over the course of next year. The OBR’s updated forecast though does suggest the eroding impact of inflation will reduce living standards by 7% over the two financial years to 2023-24, wiping out the previous eight years’ growth, while unemployment is expected to rise from 3.6% today to 4.9% by the third quarter of 2024.

Public finances

During his speech, Mr Hunt announced he was introducing two new fiscal rules and that the plan he was announcing met both of them. His first rule states that underlying debt must fall as a percentage of GDP by the fifth year of a rolling five-year period, while the second states that annual public sector borrowing, over the same time period, must be below 3% of GDP.

The Chancellor went on to reveal updated public finance forecasts, which predict government borrowing in the current fiscal year will rise to £177bn before falling back to £69bn (2.4% of GDP) in 2027-28. This means the medium-term fiscal outlook has materially worsened since the previous OBR forecast produced in March, which had predicted borrowing of £32bn by 2026-27. The OBR said this deterioration in the public finances was due to a weaker economy, higher interest rates and higher inflation.

Personal taxation, wages and pensions

The Chancellor went on to make a raft of key personal taxation, wages and pension announcements.

The government will increase the National Living Wage for individuals aged 23 and over by 9.7% from £9.50 to £10.42 an hour, effective from 1 April 2023.

The commitment to the pensions Triple Lock remains, which will increase the State Pension in line with September’s Consumer Prices Index (CPI) rate of 10.1%. This means that the value of the basic State Pension will increase in April 2023 from £141.85 per week to £156.20 per week, while the full new State Pension will rise from £185.15 to £203.85 per week.

The Income Tax additional rate threshold (ART) at which 45p becomes payable will be lowered from £150,000 to £125,140 from 6 April 2023. The ART for non-savings and non-dividend income will apply to taxpayers in England, Wales and Northern Ireland. The ART for savings and dividend income will apply UK-wide.

The Dividend Allowance will be reduced from £2,000 to £1,000 from April 2023, and to £500 from April 2024.

The annual Capital Gains Tax exemption will be reduced from £12,300 to £6,000 from April 2023 and then to £3,000 from April 2024.

The change to Stamp Duty Land Tax threshold for England and Northern Ireland, which was announced on 23 September 2022, remains in place until 31 March 2025. The nil rate threshold is £250,000 for all purchasers and £425,000 for first-time buyers.

In addition:

Business measures

Cost-of-living support

The Energy Price Guarantee (EPG) per unit will be maintained through the winter, in effect limiting typical energy bills to £2,500 per year. From April 2023 the EPG will rise to £3,000 per year, ending March 2024. The government will double to £200 the level of support for households that use alternative fuels, such as heating oil, liquefied petroleum gas, coal or biomass.

The Chancellor announced that there will be targeted cost-of-living support measures for those on low incomes, disability benefits and pensions. In 2023-24 an additional Cost of Living Payment of £900 will be provided to households on means-tested benefits, £300 to pensioner households and £150 to individuals on disability benefits. Rent increases in the social housing sector will be capped at 7% in the next financial year.

Education, health and social care

To promote education and boost the UK’s health and social care system, Mr Hunt announced:

Priorities for growth

Next, the Chancellor moved on to outline his three priorities for economic growth: energy, infrastructure and innovation. Key announcements included:

Other key points

Closing comments

Jeremy Hunt signed off his announcement saying, “There is a global energy crisis, a global inflation crisis and a global economic crisis, but the British people are tough, inventive and resourceful. We have risen to bigger challenges before. We aren’t immune to these headwinds but with this plan for stability, growth and public services, we will face into the storm… I commend this statement to the House.”

Author: TOMD

![]()

This month has seen even more political change and hopefully this will lead to some stability but as I type this I am waiting to see if the new prime minister will be Rishi or Penny.

This month’s articles are an update on the Trust registration service as time is running out to register, John Diaz has written an article on VCT’s as these are a little known tax break investment. Beth has written about the markets and John Merrifield has written about annuities coming back into focus as interest rates have increased.

The Trust Registration Service (TRS) opened in 2017 with the aim of digitalising the trust registration process. Following the UK’s adoption of the EU’s Fifth Anti-Money Laundering Directive (5MLD) in 2020, changes to the TRS were required in order for HMRC to fulfil its obligations under the new regulations.

The new rules require all UK express trusts and some non-UK trusts (including most non-taxable trusts) to register with HMRC. The TRS began accepting registrations from non-taxable trusts in September 2021, with an initial deadline of 10 March 2022. Due to delays in getting the TRS prepared, this deadline was later amended to 1 September 2022.

Rules relating to non-taxable trusts

The September 2022 deadline applies to all trusts that existed on or after 6 October 2020 – even if they are now closed. Following this deadline, all new trusts (and any changes to the details of existing trusts) must be registered within 90 days. In order to not penalise trusts set up close to the September 2022 deadline, however, the 90-day rule will also apply to trusts set up on or after 2 June 2022.

Which non-taxable trusts are exempt?

There are some trusts that are exempt from registration unless they pay UK tax. Some examples include trusts used to hold money or assets of a UK-registered pension scheme, trusts holding life insurance and other policies that pay out upon a person’s death, charitable trusts and will trusts.

We understand that the rules relating to trusts are complex, so please don’t hesitate to contact us if you are unsure.

Author: Richmond House Wealth Management

It is safe to say that the ‘mini-budget’ statement of 23 September was not well received, causing an unprecedent devaluation of sterling and decreasing investor confidence in the government. Amongst a host of measures there was a silver lining, confirmed by former Chancellor Kwarteng, for the ongoing support of Enterprise Investment Schemes, Venture Capital Trusts and Seed Enterprise Investment Schemes, by extending them beyond the 2025 ‘Sunset Clause’.

In this article I will outline the importance of these types of investments, why the ‘Sunset Clause’ was removed and the opportunity this brings.

Now, more than ever, what the UK economy needs is the capital and operational expertise that businesses require to grow and succeed, creating jobs, driving economic growth, and building stronger, more sustainable companies.

That is precisely the job of venture capital firms through Enterprise Investment Schemes, Venture Capital Trusts and Seed Enterprise Investment Schemes. The emphasis is on early-stage growth companies that are crucial for the economy.

Growth in the supply of venture capital in the UK has been heavily influenced by the tax and regulatory regime, by developments in capital markets, and by the industrial environment. Investing into Enterprise Investment Schemes, Venture Capital Trusts and Seed Enterprise Investment Schemes offer an immediate 30% Income Tax relief plus additional tax benefits.

The UK is Europe’s leading centre for venture capital, capturing almost a third of all venture capital investments in Europe during 2020. Upon leaving the EU, the ‘Sunset Clause’ was introduced by the Treasury to reduce the tax efficiency on new investments post 6 April 2025. This clause was requested by the European Union to review the assistance the UK government was providing to UK businesses. The prospect of such a ‘Sunset Clause’ had sparked considerable alarm. Many UK venture capital bodies have raised concern over the closure of the schemes, which they have said would deter investors in young, high-risk startups.

The removal of the ‘Sunset Clause’ provides support not only for investors but also for the entrepreneurs and smaller companies who drive growth in the economy with the significant help these schemes offer. This recognition of the hugely important role they play, allows companies continued access to the all-important finance they need to achieve their goals.

The good news for the individual investor is that the opportunity to invest tax efficiently remains open for business. The generous tax breaks that will now continue, offer a combination of tax-free income, deferral of a previously realised capital gain, a tax-free gain and, of course, an Income Tax liability reducer. These can be particularly attractive to higher earners who face restrictions on pension funding.

References

https://ifamagazine.com/article/huge-boost-to-eis-and-vct-sector-with-the-end-of-the-sunset-clause-and-increases-in-seis-level/

https://view.ceros.com/intelligent-partnership/vct-september-2022/p/17?aff=IPemail&src-Sep22VCTUpdate

Author: John Diaz, Chartered Independent Financial Planner

While investing in the stock market is typically a sensible choice for investors seeking long-term growth, sharp drops can still be hard to stomach. Below are some things to keep in mind if a market tumble makes you feel the need to ‘do something.’

Downturns aren’t rare events

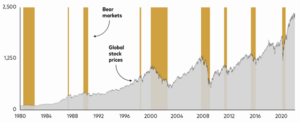

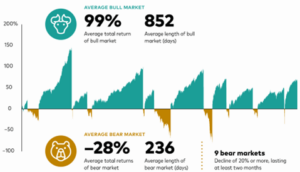

Typical investors, in all markets, will endure many bear markets during their lifetime. A bear market refers to market declines of 20% or more, lasting at least two months. Since 1980 there have been 9 bear markets.

Sources: MSCI World Index from January 1, 1980, through December 31, 1987, and the MSCI AC World Index thereafter.

Although the downturn that began in March 2020 doesn’t meet the definition of a bear market because it lasted less than two months, it has been included in the analysis because of the magnitude of the decline.

Dramatic market losses can sting, but it’s important to keep a long-term perspective and stay invested in order to participate in the recoveries that typically follow. Some bear markets since 1980 have been sharp, but many bull market surges have been even more dramatic, and often longer, leaving investors well compensated over the long term for the risk they took on.

Sources: Vanguard calculations, using the MSCI World Index from January 1, 1980, through December 31, 1987, and the MSCI AC World Index thereafter. Indexed to 100 as of December 31, 1979.

Timing the market is futile

Trying to time the market runs the risk of missing the best-performing days. The best and worst trading days often happen close together and occur irrespective of the overall market performance for the year.

What you can do when volatility hits:

Following these simple steps can help you avoid overreacting to short-term downturns and position you for long-term success.

Source: Vanguard Asset Management, Limited – Discipline may be the best defence in market downturns

Author: Beth Mills, Will Writer and Trainee Financial Planner

bmills@richmondhousewm.co.uk

Tel: 01438 342430

An annuity is a product that turns an individual’s pension savings into an income for life. Many more people will now be looking at using some of their retirement cash to buy one.

Increased rates

Latest figures show that annuity rates have leapt by 44% in the space of a year and are now at their highest levels since early 2009. Someone aged 65 with a £100,000 pension pot could now get an annuity income of £7,191 a year – up from £4,989 in October last year1.

It has long been the case that one way to use your pension pot is to buy an annuity. This gives you a regular guaranteed retirement income for the rest of your life or for a fixed term.

However, for a long time, annuities were viewed as poor value. Demand for them fell off a cliff after the government introduced a range of ‘pension freedoms’ in 2015 that meant people no longer had to take one out. Low interest rates and increased life expectancy also meant that annuity rates tumbled.

The financial and economic backdrop is now very different. When interest rates rise, so do annuity rates. They have been turbocharged by soaring long-term gilt yields (the interest rate on UK government bonds). Being able to guarantee at least a part of your income in retirement is invaluable.

Meanwhile, one of the sector’s big names, Standard Life, said this month that it is ‘seeing renewed interest in annuities given the income security they offer in the current market environment’.

A choice of annuity types

Once you buy an annuity, you can’t normally change your mind, so you may want to seek some independent advice as there are lots of different types.

For example, do you want your annuity income to stay the same or increase each year? Do you want a single-life annuity or one that provides an income for your spouse, civil partner or other dependant after you die (a joint-life annuity)? If you have a medical condition, are overweight or smoke, you might be able to get a higher income by opting for an enhanced or impaired life annuity.

The key point is that an annuity does not have to be bought at the date of retirement – rates are increasingly attractive the later you buy.

A sensible approach

Many retirees are dissuaded by the fact that once you’ve bought an annuity, the rate is locked in forever. Those sitting on lower rates purchased in previous years can’t benefit from more recent rises. However, it’s always worth bearing in mind that you don’t need to lock into an annuity with your entire pension pot all at once. One sensible approach is to do it with tranches of your pension in stages, securing income to meet your needs, as and when it makes sense for you. This gives you the opportunity to secure higher rates as you get older or to qualify for an enhanced annuity if you develop a medical condition at a later point, boosting your income again.

Many more people will now be looking at using some of their pension fund to buy an annuity while leaving the remainder invested and taking variable income or lump sums through drawdown.

It is vital to remember that you don’t have to take an annuity offered by your existing pension firm – you are free to shop around and buy one from any provider, probably resulting in a better deal by doing so. The difference between the best and worst providers can be up to 15% a year extra income once medical conditions or lifestyle factors are taken into account.

1 Hargreaves Lansdown

Author: John Merrifield, Chartered Financial Planner

jmerrifield@richmondhousewm.co.uk

One of the most common questions we get asked is “How do I find out if I had a pension when I worked for XYZ Ltd. 20 years ago?” The advent of Workplace Pensions is only going to exacerbate this situation, particularly for persistent job-hoppers and those in transient industries.

While the vast majority of lost pensions, when found, will only have a few hundred or a few thousand pounds in them, there are occasions where the amounts involved are life changing. We recently had two cases of note. One where the individual knew they had a pension but had no idea how much was in it – turned out to be over £1m. The second was an individual who swore blind they had no pensions, but a chance find of some paperwork led to a pot with over £600,000 in it. These plans created their own unique problems, but the problems were far more preferable, and much more easily solvable, than the problem of getting near retirement and finding you have no pension at all.

The current way of tracing lost pensions revolves around a government website https://www.gov.uk/find-pension-contact-details. Entering details of your previous employer will then provide contact details of pension schemes associated with that employer and, from there, it’s a case of phoning or emailing along the lines of “I worked for you from March 1998 to July 2001. Was I in a pension scheme and, if so, who would know the details?”

Unfortunately, the results you get are by no means foolproof since the data supplied is on a purely voluntary basis and often is not updated when companies change pension provider or are taken over etc.

The light at the end of the tunnel is the Pensions Dashboard. In essence, the idea is that at some point in the future, you will be able to log in to the website of a government approved body and once you’ve passed the relevant security, you will be able to see all pensions that you’ve accumulated during your working lifetime and the State Pension all in one place.

A great idea but, unfortunately already several years behind schedule, and as it’s on a phased roll-out, not all pension providers will show from day one. Until then it’ll still be the above combination of hit-and-miss plus legwork.

Author: Peter Murphy, Benefits Adviser

pmurphy@richmondhousecs.co.uk

In some ways Inheritance Tax is largely an optional tax and one that with careful planning can be mitigated. Inheritance Tax is applied to the value of an individual’s estate exceeding the available Nil Rate Band (NRB) and Residence Nil Rate Band (RNRB) and is currently charged at a rate of 40%.

A common means of reducing an individual’s estate value is via an outright gift, however, this isn’t without its drawbacks, namely loss of access to capital, and the length of time it takes to successfully leave the estate (seven years).

Losing access to capital is often a major deterrent when making gifts, particularly when the future and your income/capital requirements are uncertain. This can lead to delaying the decision to gift until much later in life and as a result reduces the likelihood of the gift successfully achieving its objective.

Inheritance Tax planning is often best addressed early when the possibility of success is higher, but how can this be done without running the risk of being left with insufficient funds to support yourself, particularly if you live longer than anticipated, or meeting the cost of care is required?

One potential option is investing in assets that qualify for Business Property Relief (BPR).

What is Business Property Relief?

Business Property Relief is a tax relief that applies to some companies listed on the Alternative Investment Market (AIM), or certain unlisted companies.

‘Business Property Relief (BPR) has come a long way since it was first introduced in the 1976 Finance Act. Then, its main aim was to ensure that after the death of the owner, a family-owned business could survive as a trading entity, without having to be sold or broken up to pay an Inheritance Tax liability. Over time, successive governments recognised the value of encouraging people to invest in trading businesses regardless of whether they run the business themselves.

BPR is a well-established relief dating back 40 years, however, you should keep in mind that the value of an investment may go down as well as up and investors may not get back what they originally put in. Tax rules may change in the future, and the value of tax reliefs depends on your individual circumstances.’

Source: Octopus Investments

How can this help?

The main advantage of investing in this way is that once the investment is held for a qualifying period of two years and assuming it is held until death, these assets will not be subject to Inheritance Tax. This means the assets remain in your control and can be withdrawn if the need arises to cover capital, or income requirements.

The two year qualifying period is far quicker than the seven year period for gifts, increasing the likelihood for success, particularly for an older individual, or someone in poor health.

Risks

Like with any form of investing there are various types of investment opportunities, from funds that aim to simply provide a very modest level of growth with the main objective being the 40% Inheritance Tax saving, to more volatile investments invested directly in the AIM market.

Capital is at risk and could fall in value; due to the nature of unlisted and AIM listed companies these can be more volatile as well as less liquid than listed companies. As with any tax relief, legislation could change in future (which reinforces the importance of reviews to revisit and adjust plans on a regular basis).

Summary

Inheritance Tax Planning is best tackled with a diversified approach where a combination of gifting, Whole of Life policies, Pensions and Business Property Relief are used to achieve the objective of reducing the tax due on an estate. What is suitable for you will be dependent on your priorities, objectives, personal situation and risk appetite. As always, this article is not intended as personal investment advice. If you feel this is an area of interest, I would encourage you to arrange a meeting with your financial planner to discuss the best way forward for you.

Author: Daniel Robertson, Chartered Financial Planner

drobertson@richmondhousewm.co.uk

When the markets are not behaving as well as we would like and there are drops in the value of our investments, some might think of alternative options when it comes to investing for retirement income.

I have been asked if buying property to create an income could be a good investment instead of a pension, after all nothing is safer than bricks and mortar. But is this true?.

Prices

Property prices have certainly enjoyed growth over the years, but it is important to view the whole picture if you are thinking of becoming a landlord.

If you are considering buying a property in anticipation that the value will rise in the future, then you may find that the costs of buying and maintaining the property eat into or eliminate any profit. In addition, there is no guarantee that the value will rise at all.

Other considerations

Tax is a big consideration if you plan to sell the property in the future. You may have to pay 18% or 28% in Capital Gains Tax on any increase in the value. This is after any Income Tax on the income you have received.

There is also Stamp Duty that would need to be paid on the purchase of a property and if this is a buy to let it is higher than for a main residential property. According to the government website www.tax.service.gov.uk buying a second property for £300,000 would result in Stamp Duty of £14,000. This is on top of solicitors’ costs which could range between £800 to £1,500 depending on the purchase price. You should always get a quote from your solicitors to be clear on costs and bear in mind that even if the sale falls through you could still be liable to pay these.

Additionally, there may be renovations needed to ensure the property meets all the necessary letting regulations.

According to Track Capital the average UK rental yield is 3.63% – a reasonable source of income to help fund retirement, but actual yields vary depending on location and cannot be guaranteed. If you have gaps where the property is not rented this could leave you without any income for a period of time.

You should not underestimate the time and stress that can be involved in managing a property. Are you ready for the call complaining that a bulb has blown? Believe me, this happens! You can reduce stress by employing a management company but the downside is paying a percentage charge thus reducing your profit.

Relying solely on property for an income in your retirement means that you are putting all your eggs in one basket. You could find that you have a property that is costing you each month if you are not able to cover your costs from the rental income.

One benefit of property is that you would be able to release cash at any age, whereas with a pension you could not do this until at least age 55, increasing to age 57 in 2028. However, there would be costs to do this and limitations on the amount you could release.

Benefits of pensions

Pensions aren’t perfect but they have some real benefits over property. If you are employed, under current automatic enrolment rules your employer must contribute the equivalent of 3% of your qualifying earnings. You get an uplift on any personal contribution of 20% and possibly more if you pay a higher rate of tax.

Normally 25% of your pension pot is tax free and 75% is taxable, but you choose when to take this and depending on your type of pension, withdrawals can be managed to make the best use of personal allowances and the 20% tax bracket.

You can decide on how your pension is invested and will likely benefit from a mix of investments and professional fund management, meaning you do not have the stress of day-to-day investment decisions and a diversified approach.

There is no UK Income Tax to pay on any dividends or interest from investments within your pension and any growth is free from Capital Gains Tax.

You won’t need to find a large lump sum to get your pension started and can save little and often, as well as adding lump sums as and when you can.

On the whole, setting up and running a pension costs far less than buying a property. The way you take income from the pension is far more flexible and can be managed to be tax efficient. Although investments are subject to the vagaries of the markets, they can be invested at your own level of risk and are not relying on one asset class, they are far more diversified.

When you take money from your pension you are not subject to Capital Gains Tax and you will not have to pay a tax charge to get the pension started.

Tailored to your needs

If you would like to discuss your retirement income planning then a meeting with a financial adviser is highly recommended to make sure your plans are not only tax efficient and cost effective, but are tailored to your future.

Author: Kristina Bailey, Financial Planner

kbailey@richmondhousewm.co.uk

Market overview

Economic data continues to point to a further slowdown, with growth forecasts being cut and activity indicators such as Purchasing Managers’ Indices declining. Inflationary pressuresremain acute in most key regions, albeit we have recently seen a marginal decline in coreinflation (which excludes food and energy) in some countries.

This weaker economic backdrop raised expectations of a softening, and potential reversal, in ratepolicy in the US, perhaps as early as next year, and this drove equity markets sharply higher over the month. Global equities rose nearly 8% with growth stocks leading the way (returning 11.5%) and recovering some of their underperformance so far this year.

In terms of regions, the growth and technology-heavy US market was the key beneficiary while emerging markets lagged, pulled down by US dollar strength and weak returns from China where concerns over the property market and continued covid restrictions weighed heavily. The eurozone continues to face the most acute energy supply risk stemming from the conflict in Ukraine and, notably, the euro dipped below parity against the dollar during July as recession fears heightened.

In the UK, the resignation of Boris Johnson has to date caused little discernible effect on markets, despite the potentially significantly different fiscal policies being put forward by the two potential new leaders. Elsewhere growth orientated sectors within the UK market outperformed more defensive and value sectors, and the mid-cap area of the market staged a strong recovery.

The continued heightened inflationary environment in Europe led the European Central Bank to announce the first rate increase (50bps) in 11 years and end the negative rate environment that has existed since 2014. As expected, the US Federal Reserve also announced a further 75bps rise in rates as it continues its stated aim of targeting lowering inflation. This led to the US yield curve ‘inverting’ (i.e. 2-year Treasury yields being higher than 10-year yields) and to some concern that their actions to combat inflation will damage already fragile economic growth. Bond markets had already priced in further rate rises and the weaker economic data and some less hawkish rhetoric from central banks led to sovereign bonds rallying overall. Higher risk areas of the corporate bond market outperformed.

Returns within commodities were mixed, with agriculture and gold falling, and natural gas rising further on Russian supply concerns.

Strategy positioning

Within the equity component of the strategies, we are looking to further reduce exposure to Europe in favour of a higher allocation to Asia. The eurozone economy still looks vulnerable to continued energy supply disruption and tighter borrowing conditions, particularly for the region’s weaker periphery, and fragmentation risks are growing. In contrast we expect Asia to produce the strongest levels of economic activity globally, with China in particular expected to pursue more expansive monetary and economic policy.

Market volatility is heightened, and we prefer to stay invested and follow longer-term themes. The volatility in both equity and bond markets is, however, throwing up opportunities that we believe we can profit from.

We remain committed to equities – company earnings announcements remain relatively robust, valuations look undemanding, and we believe equities continue to offer the best potential for real returns over the medium term. We continue to favour the US market based on the resilience and strength of both the economy and the corporate sector. We remain comfortable with the exposure to infrastructure, which has performed strongly so far this year and offers relatively stable returns and valuable inflation protection.

Bond yields have moved quite dramatically so far this year and the likely shorter-term actions of central banks has largely been priced in. Given the relative movement in yields. we see limited future opportunity at the front end of the curve and have marginally increased allocation to the longer end. The overall duration of strategies has therefore increased slightly.

We expect the alternatives component of the strategies to continue to play a very important role in contributing absolute returns and reducing overall volatility. In some of the strategies we have initiated a new investment in an equity market neutral absolute return fund managed by UK investment boutique Tellworth. During periods of market stress this fund has proven an ability to provide both protection on the downside and positive returns.

Author: Richmond House

Risk warnings

Past performance should not be seen as an indication of future performance. The price of shares/units and income from them may fall as well as rise and is not guaranteed. The models used are typical of portfolios managed by Richmond House Investment Management. Your actual portfolio may differ depending on your individual circumstances.

The heat has definitely been on this month with record temperatures and a new prime minister to find! With this in mind we have asked Waverton to give us a view on the markets and Jonny has looked at how to combat a tough market by using structured products. John has written about claiming tax relief for working from home during Covid and John D has looked at when to draw from your pension and the impact that it can have on the long term performance.

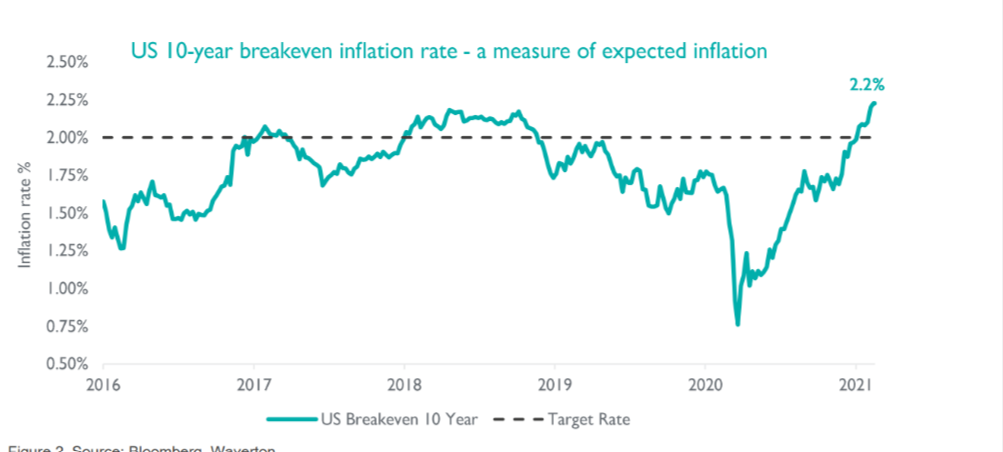

CIO Bill Dinning set the scene, highlighting that, although inflation has been elevated, in recent weeks the market’s mood seems to have shifted focus and become more worried about the policy response to the inflation. Headline inflation is still running at 40-year highs – over 8% in US, UK, and Europe – but expectations of future inflation have fallen back lately. Five-year inflation swaps – a market measure of expected average inflation over the coming years – seem confident that inflation will head back towards 2%. Indeed, longer term inflation expectations appear less concerned about elevated inflation than they were in the wake of the global financial crisis.

Although inflation is still a problem, markets are now anticipating that the Federal Reserve will finish hiking rates in the first quarter of 2023 and will need to start cutting them again shortly after that. This shift in expectations has come about due to worries that rising interest rates, coupled with inflation, will cause an economic slowdown, or even a recession. Although there is plenty of worrying data that supports this premise, if the Fed are able to effect a few more hikes then they have actually got some flexibility to try and prevent too much damage. Their abilities are enhanced by the fact that they are now engaged in Quantitative Tightening. Not only are they raising interest rates, but they are also tightening monetary policy by reducing the size of their balance sheets. If they wish to adjust their policy stance as they seek to steady the economy, then they can alter the rate at which they reduce their balance sheets. They have more options than in recent years. Although the risk of recession is material, it is not a given – the Waverton Asset Allocation Committee gave it a 40% probability at their end-June meeting.

Source: MSCI, Factset, Waverton as at 01.07.22

It is not all bad news though; the fall in equity and bond prices has provided some interesting investment opportunities. The Price Earnings ratio for US equities has fallen back to its long-term average, and the global ex-US average is now below its historic mean. There are concerns that earnings may begin to disappoint in coming months, but there are attractive valuations appearing. We are currently neutrally positioned on equities but, as things stand, it is perhaps more likely that our next step is to increase our equity allocation rather than reduce it.

Head of Fixed Income and Fund Manager Jeff Keen spoke next, highlighting the difficult backdrop that bond investors have endured so far this year – in the UK, government and corporate bonds are both down more than 14%, their worst starts to a year for several decades. There have been no hiding places. In some regards, the combined bond and equity damage in 2022 is similar to the economic slowdowns following the dot-com bubble and during the global financial crisis.

If a recession is on the cards, then it might be that bonds, particularly longer-dated government bonds, are able to offer some protection. As the chart below shows, in the US there has been a recent disconnect between the 12-month change in the ISM Manufacturing Purchasing Managers’ Index and the equivalent change in the 10-year Treasury yield. If the relationship is to hold then we would expect one of the two to adjust. An improvement in the ISM is perhaps less likely given the current macro backdrop, suggesting that a fall in the 10-year bond yield might be realistic. The Waverton Sterling Bond Fund has been increasing its duration accordingly but, given the active manner in which it is managed, this can be quickly adjusted should the data or convictions change.

Although the rise in yields has been negative for fixed income returns, it has provided some good value propositions in the credit markets. The shift up in yields has been particularly pronounced in the short end, meaning that it is now possible to buy some low-duration, investment grade bonds with appealing yields. We are not confident enough in the strength of the economy to be broadly increasing credit exposure but are being opportunistic when value presents itself.

Source: Institute for Supply Management, Bloomberg, Waverton. Data as at 30 June 2022.

Luke Hyde-Smith, Co-Head of Multi-Asset Strategies and Fund Manager, spoke on the opportunities in alternative assets. As with bonds and equities, alternatives have had a volatile start to the year, but they are able to play an important role in a portfolio. As the chart below shows, when inflation is elevated, historically we have seen a positive correlation between bonds and equities – meaning bonds and equities have tended to fall together. We have seen this in recent months, even though the correlation is still negative on a three-year basis. If bonds are not reliably protecting against equity market falls, then this has major implications for portfolio construction. Alternatives can be part of the solution.

Alternative assets can broadly be grouped into two categories: absolute return, which are diversifying strategies seeking to protect capital in weak markets, and real assets, which tend to be long-only and return-seeking. These assets not only offer diversification but can provide attributes such as volatility dampening and inflation-linked returns. There has been a widening of discounts within the investment companies sector and certain areas of commodities appear attractive – both of which fall into the alternatives bucket.

One area of alternatives that is of particular interest is assets that are associated with the energy transition. Between January 2020 and November 2021, the number of countries with net-zero commitments rose 7x, from 21 to 140. Over the same time, the number of companies rose 5x and financial commitments rose 26x, from $5 trillion to $140 trillion. This growth can increase demand for some metals like nickel and lithium and some energy companies are likely to benefit too: the energy sector is only 4% of market capitalisation of the S&P 500, far below its historical average. Alternative investments are able to benefit a portfolio with thematic investments such as these.

Source: Bloomberg, Minack, Waverton. As at 30.06.22.

The views and opinions expressed are those of Waverton Investment Management Limited and are subject to change based on market and other conditions.

The information provided does not constitute investment advice and it should not be relied on as such. It should not be considered a solicitation to buy or an offer to sell a security.

All material(s) have been obtained from sources believed to be reliable, but its accuracy is not guaranteed. There is no representation or warranty as to the current accuracy of, nor liability for, decisions based on such information.

Past performance is no guarantee of future results and the value of such investments and their strategies may fall as well as rise. Capital security is not guaranteed.

Author: Waverton

A structured plan is normally linked to an index such as the FTSE100 Index. The plan typically has a fixed term of 5 or 6 years, and the returns are based on the performance of the Index over that period.

However, it is the ability to achieve a positive return even if the index falls that is the most attractive feature of these plans. The Defensive Kick Out plans that are proving most popular potentially provide an annual return that depends on the level of the Index each year. As an example, below, the first opportunity for the plan to mature early is year 2 and the coupon (return) of 8.25% is annualised

As long as the FTSE100 Index is above the trigger level at the anniversary date, your capital is returned plus the growth so you know exactly what you may get back. However, as you would expect there are risks:

For those who do not want to take any investment risk, there are Deposit structured plans that are akin to a bank account, but the returns are based on the FTSE100 Index not interest rates. These plans are covered by the FSCS, and the returns are generally higher than cash deposits.

These are available in tranches, so please ask your adviser for up to date information on current availability.

The recent Structured Product Annual Performance Review 2020, compiled by StructuredProductReview.com, continues to provide the most comprehensive analysis of structured products in the UK which goes to re-inforce why they should be considered only as part of a well-diversified portfolio.

The huge advantage of structured plans is they can be back tested, and the results are binary as they either work or do not, for example:

We have full access to the market and can provide independent research on all the plans that may be suitable. It is possible to hold these plans directly or invest in structured plans through your self-invested pension and your ISAs, meaning the returns are not only attractive but can be tax efficient.

Structured plans are not for everyone, but as an agreed proportion of a portfolio they can provide diversification and a different method of achieving long term sustainable returns which can include capital growth or monthly income.

Should you wish to receive further information, please contact your usual planner in order that we can prepare a recommendation based on your specific requirements.

Author: Jonathan Howard

Jhoward@richmondhousewm.co.uk

Tel: 01438 345767

Employees returning to the office can still claim for household expenses for this tax year, says HM Revenue and Customs (HMRC), whose figures revealed nearly 800,000 have claimed tax relief since April 2021.

Myrtle Lloyd, HMRC’s Director General for Customer Services, said: “More people are getting back to office working now, but it’s not too late to apply for tax relief on household expenses if they’ve been working from home during the pandemic.”

You can claim the full year’s tax relief entitlement of £125 if your employer told you to work from home even if it was only for one day! It doesn’t matter if you have returned to the office since early April; you can still get the full amount for the 2021/22 tax year. It’s OK if you work from home for just some of the week.

However, you cannot claim tax relief if you choose to work from home. Nor can you claim tax relief if your employer covered your expenses or paid you an allowance. If you complete an annual tax return, you will be able to apply for the tax relief via your Self Assessment.

You can use the HMRC working from home tax relief portal, where you will be asked a series of questions to check if you are eligible or not. To progress with your claim, you will need a Government Gateway user ID and password, which you can create if you don’t already have one. This should take about 10 minutes to create.

To create a Government Gateway ID, you will need your National Insurance number and a form of ID such as a recent payslip or P60, or a valid UK passport. If you are claiming an exact amount for costs then you will need evidence such as receipts, bills or contracts.

Each employee can claim up to £125 per year. This is made up of either £6 a week from 6th April 2020, or the exact amount of extra costs incurred above the weekly amount, for which you will need the evidence mentioned above.

Tax relief is based on the rate at which you pay tax, so if you pay the 20 per cent basic rate of tax and claim tax relief on £6 a week you would get £1.20 per week in tax relief (20 per cent of £6) which would result in £62.40 a year. Higher rate taxpayers can claim £2.40 a week (40 per cent of £6 a week), which would result in £124.80 a year.

You may be able to claim tax relief towards bills including gas and electricity, metered water, business phone calls and internet costs. You may also be able to claim tax relief on equipment you have purchased such as a laptop, chair and desk or mobile phone, for example. You cannot claim for the whole bill — just the part that relates to your work.

Once your application has been approved, your tax code will be adjusted for the 2022/23 tax year and you will receive the tax relief directly through your salary.

If you were required to work from home during the 2020/21 tax year but did not claim for the tax relief, it’s not too late. You can backdate claims for up to four years and will receive a lump sum payment if you are successful. Some workers will be able to claim for the current tax year 2022/23 but many people won’t be eligible for this tax year as it is no longer a legal requirement to work from home.

Author: John Merrifield, Chartered Financial Planner

jmerrifield@richmondhousewm.co.uk

Most people hate to accept a downturn in their lifestyle and will often strenuously oppose the idea that they could do without some of the things that support it. The inescapable fact is that spending more now almost certainly means spending less later.

Many clients have received very strong investment returns in recent years and it may be tempting for them to assume that future returns will restore their fund values even after more money has been withdrawn.

A key element of our advisory role is to help clients consider the impact of sequencing risk, so-called ‘pound cost ravaging’. Using tools such as cash flow forecasting, we can show the impact of increased spending and also model alternative scenarios such as ‘what if I spend less?’ to bring a focus on longevity and income sustainability.

A fund value that is reduced in value now will have to work much harder in future. Even if returns improve, the return will be made on a smaller fund and it may never catch up with the overall growth it might have achieved. An extreme example to illustrate the point is that, if a fund reduces by 50%, it needs to grow by 100% to recover!

Clients who have already survived a few years of income drawdown will have built up larger funds, but may still need to review core and discretionary expenditure. The discretionary expenditure such as holidays, socialising etc could be reduced to ensure their lifestyle can be maintained long term.

Offsetting increased energy bills by reducing other expenditure, if possible, will almost certainly deliver a better result.

Clients working towards retirement should also be made aware that drawing taxable income will also impact on their ability to save more into their pension. Taking income from a pension triggers a cap on future pension contributions, which can be exceeded through ongoing personal and employer pension contributions though this incurs an annual tax charge.

In addition, HM Revenue & Customs has still not seen fit to alter the position with regard to emergency tax on these income payments and clients very often get a shock when they see how much has been deducted. The excess can of course be reclaimed, but this will not help if the client has an essential bill to pay immediately.

Since the introduction of pension freedoms in 2015 annuity sales have plummeted, partly because annuity rates have been at their lowest level for some time due to ultra-low interest rates and increased life expectancy.

With the onset of inflation, central banks around the globe have been increasing interest rates as their defence mechanism. As a result, annuity rates have started to rise and the option of a guaranteed income has become more attractive. This could suit clients who have been in drawdown and who would like to reduce their exposure to investment risk in exchange for some security against longevity risk. These clients may well benefit from another look at full or partial annuitisation in the next few months to cover core household expenditure.

In summary, the expectation is that inflation will fall in 2023 and in 2024, before settling around the Bank of England’s target of 2% for CPI (Consumer Prices Index). Clients should be mindful of core and discretionary expenditure, to ensure withdrawing pension income earlier than planned does not incur an unnecessary tax liability and put the sustainability of their retirement at risk in reaction to short-term pressures.

Source FT Adviser 12.07.22

Author: John Diaz, Chartered Independent Financial Planner

This has been a tough month for investments and recently the impact of rising base rate has caused a downturn. Dan has written an article on how this effects the timing of investing and Beth has covered off the importance of having financial advice alongside your portfolio. Kristina is looking at saving tax on your bonus and Peter has discussed how to provide company benefits and when to review them.

Right now there are a lot of factors causing uncertainty and driving market sentiment, in particular a high inflationary environment, rising interest rates, reducing growth expectations and the ongoing conflict in Ukraine. Many experts attempt to predict what will happen in the short term and inevitably just as many are wrong that are right. However, investing is not about speculating on the outcome of events in the short term, instead it is about trusting in the tried, tested and proven method of holding a portfolio that is diversified in asset class, geography, sector and investment style over the long term and using experienced investment managers to add value by picking assets in their area of expertise that represent both good value and potential for growth/income.

It is important to remember there will never be a time where there isn’t something causing uncertainty e.g. recently we have had Covid, lockdowns, Brexit, Trump to name just a few. Focusing on this can lead to perpetual sitting on the fence ‘waiting for the right time’. It is however important to remember the old cliché that investing is about time in the market rather than timing the market (timing the market inevitably never works unless incredibly lucky). It is also important to remember that predicting highs and lows in the market is difficult, if not impossible, and sentiment can change extremely quickly.

To provide some context I have shown performance data below for some sector averages to show how these have performed over 1, 5, 10 years and since the start of available data.

The sector averages used are:

1 Year

5 Years

10 Years

Since Early 90s

That last graph includes the dot com bubble burst in the early 2000s, September 11th, the Financial Crisis of 2007/08 and the pandemic.

N.B. These sector equity ranges are quite broad and as an average will include many of the best and worst performing funds. They have been used because they represent an easy way to show a generic range of risk profiles and how these have reacted to various events over time, they do not represent the funds you would be recommended, although they may serve as a benchmark to determine outperformance or underperformance.

Pandemic 2020

And the highest point before the pandemic (17th January 2020):

Inflation

Given that we should be viewing any invested funds over a minimum of 5 years the short term ‘noise’ is a distraction and investing in a diversified manner is very likely to outperform inflation and provide capital growth over the long term. Historic Performance including Inflation measures CPI and RPI and short-term cash returns shown below:

10 years

Since start of data:

In Summary

Ultimately there will always be something happening that might impact markets in the short term, however inflation will almost certainly erode the purchasing power of your cash holdings, particularly given where bank interest rates are and investing with some exposure to markets as shown above has historically offered far better protection against this.

This article is not advice. Contact your adviser if you would like to discuss whether investing now will help you meet your own personal objectives and fits your risk profile.

Author: Daniel Robertson, Chartered Financial Planner

drobertson@richmondhousewm.co.uk

Tel: 01438 345745

Engaging with a financial advisor can increase the value of your overall wealth which means your key financial objectives can be met and managed. The key areas identified by Vanguard (one of the largest global asset management groups) as visible enhancements from engaging with a financial planner were:

Asset allocation – the overwhelming factor in determining investment performance

A financial advisor will help you establish your objectives for the investment. They will create a well thought-out investment strategy, identifying the right blend of investments for you. This ensures that you take the right level of risk and are best placed to achieve the returns you need.

Rebalancing – keeping a portfolio’s risk and return profile on course

A financial advisor will review the portfolio and recommend rebalances as required to ensure that you maintain the right investments for your current objectives and don’t take too much or not enough risk.

Lowering costs – the one factor guaranteed to improve returns

Every penny counts, anything you pay in costs erodes your future returns. A financial advisor can reduce your charges by providing access to institutional investments with lower costs. This ensures you keep more of any investment return.

Behavioural coaching – avoid the costly mistakes of giving in to fear and greed

Individuals automatically want to avoid pain and seek pleasure, which can result in selling our investments when they fall, and buying them when they rise.

A financial advisor will provide sound, objective advice, helping you stick to the plan and remain invested, avoiding any expensive mistakes.

Tax allowances – tax-efficiency is key to getting the best results

A financial advisor will help you work out which investment vehicle and tax-wrappers are right for you based on your tax position. They will consider the tax rate you pay now for current planning and then ensure you withdraw your money in the most tax efficient way over the years.

Cashflow Modelling – crucial to maintaining the value of a portfolio in retirement

Creating a withdrawal strategy for your investments with your financial advisor will ensure that withdrawals are as tax-efficient as possible and that your investment strategy and risk appetite is still suitable the closer you get to retirement.

Author: Beth Mills, Will Writer and Trainee Financial Planner

bmills@richmondhousewm.co.uk

Tel: 01438 342430

With the cost of living rising at such a rate that many families are having to give consideration to normal costs such as heating, food, clothing and other outgoings, a bonus arriving in your pay packet can be a very welcome sight.

Inflation has now reached 9.1% and predicted to rise to 11% later this year. The government is attempting to manage this by increasing the Bank of England base rate which now stands at 1.25% the highest it has been since 2009.

This is unlikely to be the end of the rises with speculation that we could be looking at a base rate of 3% before too long. The idea is that increased rates of interest will mean we borrow and spend less and tend to save more. This combined behaviour should bring inflation down. Although rate rises will eventually please savers, it will put extra pressure on those with a mortgage who are looking at increased mortgage payments on top of increased monthly expenditure.

So, less of the doom and gloom and back to the bonus payment. Receiving a bonus is often thanks for a job well done and it makes sense to make the best use of this and if possible not gift part of it away to the government.

The thought of this being used for a holiday or other luxuries is very tempting and who could blame us. We have had a pretty rubbish time of things over the last few years with lockdowns preventing us doing many things we previously enjoyed and possibly took for granted.

The issue is that if the bonus is paid as part of your salary then depending on your total income you will pay tax on this extra amount at your highest rate if income tax. This could mean losing 20%, 40% or 45% of it. Not something that any of us would like to do.

One way to avoid paying tax on this would be to have the amount paid to your pension instead. If this is done via salary sacrifice then it will never be taxed and the full amount can be contributed directly to your scheme, allowing you to keep more and add to your tax efficient savings for the future.

If giving up all your bonus is just too sensible, then it may be that your employer will allow you to split the amount, so you could have the best of both worlds keeping some for something nice or necessary and put the rest away for your future.

Some employers will also top up the pension contribution with the amount that they will save in your national insurance contribution, so a bonus for your bonus.

It is not always clear what your options are with a bonus payment and not all employers have advisers to help with these type of decisions. If you are at all unsure then seeking professional advice would be recommended.

It may be that you are in the position that your pension is already at risk of breaching the pension Lifetime Allowance of £1,073,100 and suffering a potential future tax charge and if so, you may be looking for other tax efficient ways of investing your bonus.

If the idea of helping young companies and having a tax efficient investment at the same time appeals, then Venture Capital Trusts (VCT) could be for you. You may be able to claim back up to 30% income tax relief on the amount you invest, provided you are happy to hold the investment for 5 years. So, if your bonus does suffer from income tax you can still get some of this back. These are not for everyone but a conversation with your financial adviser will assess the suitability of this type of investment and other potential options.

So before you book that holiday and join the queues at the airport, please give some consideration to your other options.

Author: Kristina Bailey, Financial Planner

kbailey@richmondhousewm.co.uk

Nobody’s pretending it’s easy out there. Fuel heading towards £2 a litre. Supply chain problems due to Russia’s unconscionable invasion of Ukraine. Inflation running rampant across the board. It almost makes you nostalgic for the days of Covid!

Employers are as susceptible to these factors as individuals and, like a lot of the public, any way to cut costs will be eagerly welcomed. But what are your genuine options?

This article will look at the main types of employee benefits and what can be done to ensure costs are kept as low as possible.

Pensions

There are rules laid down in law for minimum contributions, so there is no option to stop or suspend contributions.

Many companies pay more than the minimum so could, at least in theory, reduce contributions for a period but, before doing this, they need to ask themselves what the effect on their employees would be. Would staff see this as a sign of an employer in trouble and start to look elsewhere, possibly reducing the talent pool and restricting future opportunities once something approaching normality returns?

Playing with the pension scheme is a highly contentious issue and one that should only be considered once all other options have been exhausted.

Group Life and Income Protection

These are pure insurance contracts so cost is really the only factor provided the other benefits are the same.

Therefore, employers should ensure they are regularly reviewing the market, usually via their advisers, to get the best cost. This is normally done every 2 to 3 years but can be done more frequently and is certainly worth the effort if there has been any significant change in staff numbers, up or down.

Private Medical Insurance