Inheritance Tax Overview

The roots of Inheritance Tax in the UK can be traced back to the late 17th century when various forms of estate duties and legacy taxes were introduced to finance government expenses such as wars. These early taxes were not uniform and were often ad hoc.

Interestingly, during the late 18th and early 19th centuries, England faced financial strains due to wars with France. As a result, legacy and succession duties were introduced in 1796 and 1805. These duties were imposed on legacies left in Wills and inheritance of property upon death. The legacy and succession duties were consolidated into a single tax known as the Legacy Duty Act in 1853. This Act laid the foundation for a more structured approach to taxing inheritance.

The Finance Act of 1975 replaced estate duty with Inheritance Tax (IHT) as it is known today. The IHT system was designed to be more flexible and encompassing, with rates linked to the value of the estate and exemptions for certain types of assets and gifts.1

Each individual has an Inheritance Tax threshold, also known as the nil-rate band (NRB) – for the current tax year this is £325,000. If the value of the estate is below this threshold, no Inheritance Tax is due. If the estate is worth more than this threshold, tax is typically paid on the amount exceeding the threshold. The standard Inheritance Tax rate on the portion of the estate that exceeds the threshold is 40%. So, if an estate is valued at £400,000 and the threshold is £325,000, Inheritance Tax would be due on the £75,000 above the threshold at a rate of 40%.

Whilst the Inheritance Tax nil-rate band has remained frozen since tax year 2009/2010 at £325,000 per individual, the introduction of the Residence Nil-Rate Band (RNRB) in 2017 was a significant change to IHT. It allowed for an additional tax-free allowance when passing on the family home to direct descendants (children, stepchildren or grandchildren). The RNRB aimed to make it easier for families to pass on their primary residences without incurring a substantial IHT bill.

This was a welcome change as official figures from the Office for National Statistics (ONS) show average UK house prices rose from £167,716 in January 2013 to £290,000 at the end of January 2023 – a gain of 73%.2

The Autumn Finance Bill 2022 confirmed that both the NRB and the RNRB will be fixed at their current levels until the end of 2027/2028.3

1The History of Inheritance Tax, Final Duties December 2021

2This is Money, April 2023

3HMRC

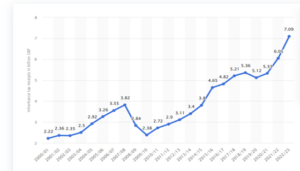

Inheritance tax receipts in the United Kingdom from 2000/01 to 2022/23(in billion GBP)4

As house prices have risen, inheritance tax has become an issue of concern for more and more people, with an increasing number holding assets in excess of the NRB and RNRB thresholds. For those who would like to maximise the legacy they can leave to their beneficiaries, there are some IHT mitigation strategies to consider.

- Annual Gifting: You can make tax-free gifts of up to £3,000 per person each year. This is known as the annual exemption. Gifts made more than seven years before your death are generally exempt from IHT.

- Spousal Exemption: Assets passed between spouses or civil partners are typically exempt from IHT. Consider the potential benefits of joint financial planning with your partner.

- Gifts for Special Occasions: You can make additional tax-free gifts for specific life events, like weddings (up to £5000) or civil partnerships, as long as they meet certain criteria.

- Lifetime Gifts and Potentially Exempt Transfers (PETs): Gifts made more than seven years before your death are generally exempt from IHT. However, if you pass away within seven years of making a gift, it may still be subject to IHT on a sliding scale.

- Gifts Out of Surplus Income: Regular gifts made out of your surplus income can be exempt from IHT. Proper record-keeping is crucial in these cases.

- Trusts: Trusts can be a valuable tool for IHT planning. They allow you to set aside assets for beneficiaries while potentially reducing your IHT liability. Seek professional advice when using trusts, as they can be complex.

- Charitable Giving: Gifts to registered charities are entirely exempt from IHT. Leaving at least 10% of your net estate to charity may reduce the overall IHT rate on the taxable estate to 36%Life Insurance Policies: You can use life insurance policies written in trust to provide a tax-free lump sum to cover the IHT liability on your estate.

- Life Insurance Policies: You can use life insurance policies written in trust to provide a tax-free lump sum to cover the IHT liability on your estate.

- Pension Planning: Pensions are outside the scope of IHT. Consider maximising your pension contributions as part of your overall estate planning strategy.

- Business Relief: If you own a qualifying business or shares in a qualifying unlisted company, you may be eligible for Business Relief (BR). BR allows a significant reduction or exemption from IHT on those assets. Seek professional advice on how to structure your business to maximise this relief.

- Agricultural Property Relief (APR): If you own agricultural property and meet certain conditions, you may be eligible for APR, which can provide relief from IHT.

- Investments in IHT-Exempt Assets: Some investments, such as AIM-listed shares, qualify for Business Relief and may be exempt from IHT after a specified holding period.

Crafting a comprehensive estate plan can help minimise IHT. This involves organising your assets, creating a will, and appointing executors and guardians if needed. IHT planning can be intricate, and tax laws evolve. Your financial planner can tailor a strategy to your specific circumstances and keep you updated on any legal changes. For more information on inheritance tax planning or any of the strategies cited above, please contact your financial planner directly or email info@richmondhousewm.co.uk.

4Statista, 2023

Whole of Life Insurance – a way to ensure your family receive the full value of your legacy

What is Whole of Life Insurance?

Life insurance is commonly used for a fixed period to cover a liability such a mortgage. It will pay out a lump sum on death.

With whole of life insurance there is no end date to the cover. Therefore, as long as you continue to pay the premiums, it is guaranteed to pay out on death.

How does it work?

Your financial adviser will discuss your needs with you and obtain a quotation for the level of cover you require. Underwriting may be required – a process where the insurer will review your health position to decide the right level of premium.

If you accept the quotation you will agree to pay a monthly premium to provide a lump sum payment on death. This can be paid to your nominated beneficiaries, usually the executors of your estate. Cover will continue for as long as you pay the premiums. The level of cover, and/or premiums may be assessed during your lifetime.

You can stop paying the premiums at any time; however, the cover will cease.

Why would you use Whole of Life Insurance?

If, when you die, your legacy is worth more than the available Inheritance Tax nil rate band (NRB), there may be an Inheritance Tax liability due on your estate. This is usually 40% of the value above the NRB.

The tax needs to be paid before the estate can be released, which can hold up payment of the legacy. It will also reduce the amount your loved ones receive.

Whole of Life Insurance can be arranged to provide a lump sum, outside of your estate, which can be used to pay the Inheritance Tax bill. It can speed up the payment process, and ensure your loved ones receive the full amount you want them to.

Advantages of Whole of Life Insurance

- It can provide a lump sum to cover any Inheritance Tax Liability, meaning your loved ones receive the full value of your estate

- It could mean that your assets do not need to be sold, so they can be passed on in full

- As long as it is set up correctly, the payment will not form part of your estate

- Other methods of Inheritance Tax mitigation involve losing access and control to some of your wealth. With Whole of Life Insurance you can retain ownership of your assets.

Disadvantages of Whole of Life Insurance

- As the cover is intended to last for life, the total cost could be expensive

- Premiums can increase in the future

- Your Inheritance Tax liability may change over time, meaning it is important to review the level of cover.

Is Whole of Life Insurance right for you?

As you can see, Whole of Life Insurance can be a great way to ensure your loved ones receive the full value of your legacy. It also means you keep full access to your wealth without having to gift any of it away.

However, there are things to consider before deciding if it’s right for you. If you are interested in finding out more, please get in touch with your financial adviser.

Wills and Inheritance Tax Planning

Inheritance Tax

When an individual dies, the net value of their estate is calculated and if it is valued at more than the nil rate band (NRB) which is currently frozen at £325,000, the surplus is taxed at 40%.

If any gifts have been made within the past 7 years, these are also taken into account when calculating the value of the estate. There is also the possibility that gifts made within the previous years could also be included, meaning there is the potential that executors have to assess gifts made within a 14 year period.

If a surviving spouse or civil partner dies after 9 October 2007 and has not made use of their NRB, their NRB can be transferred to the survivor and their allowance is increased to £650,000.

From April 2017, the Residential Nil Rate Band (RNRB) was introduced which is an additional IHT allowance of £175,000 per person and as with the NRB this can also be transferred to a surviving spouse if it was not used. This is only able to be claimed where you leave your main residence, or the proceeds of to your direct descendants. This allowance provides further scope for tax planning through Wills.

Making a Will

In a Will, you decide who will distribute your estate and who will benefit from your estate. If you do not make a Will, the intestacy rules will decide this for you.

Wills are also used to appoint guardians for children, set up trusts to control the way in which certain assets are used, protect property from being used to pay care fees and to set out your funeral wishes.

How can I use a Will to save tax?

You can gift any amount to a spouse or civil partner free of IHT due to the spousal exemption rules.

Gifts to charity in a Will are free of tax. If you gift more than 10% of your net estate to a charity within the Will then you will also benefit from an reduction in the amount of IHT you may have to from 40% to 36%.

In addition, some business assets which are gifted in a Will attract reliefs from IHT where certain conditions are met.

It may not be tax efficient to gift a tax-exempt asset to a beneficiary who is not subject to tax, as one of the tax reliefs will be wasted. There may be other planning options for you to make best use of both tax exemptions.

Transferable NRB and NRB Discretionary Trusts

Before October 2009 if an individual’s NRB was given to a spouse then it was deemed to have been used and wasted due to spousal exemption, so it was common for spouses to leave an amount up to their NRB to a trust. These were called NRB Discretionary Trusts. The purpose of the trust was to ensure that the money was used to provide for the surviving spouse if needed and to keep the money out of the surviving spouse’s estate. If the money was simply gifted to another individual, it may leave the surviving spouse short of money.

However as mentioned above if an individual dies post October 2009 and they leave their estate to their spouse, the NRB is deemed not to have been used and can be transferred to the survivor’s estate on their death.

There are a number of reasons, apart from tax saving, why trusts should be used:

- To provide greater flexibility for unforeseen circumstances

- Money in a discretionary trust is protected if the surviving spouse or civil partner goes into care

- You may want other beneficiaries as well as your spouse or civil partner to potentially benefit from the money

- To provide protection of assets where individuals are going through a divorce or for vulnerable beneficiaries

It is likely that growth in the value of the trust will be greater than any future increase in NRB due to this allowance currently being frozen. The growth would be outside the survivor’s estate and so would not be taxable on his or her death.

Therefore, it is crucial to consider all the ways available to you to save your estate paying Inheritance Tax when you die. Ultimately leaving a larger pot for your beneficiaries to inherit and enjoy.

Author: Richmond House