This month has seen even more political change and hopefully this will lead to some stability but as I type this I am waiting to see if the new prime minister will be Rishi or Penny.

This month’s articles are an update on the Trust registration service as time is running out to register, John Diaz has written an article on VCT’s as these are a little known tax break investment. Beth has written about the markets and John Merrifield has written about annuities coming back into focus as interest rates have increased.

Trust Registration Service update

The Trust Registration Service (TRS) opened in 2017 with the aim of digitalising the trust registration process. Following the UK’s adoption of the EU’s Fifth Anti-Money Laundering Directive (5MLD) in 2020, changes to the TRS were required in order for HMRC to fulfil its obligations under the new regulations.

The new rules require all UK express trusts and some non-UK trusts (including most non-taxable trusts) to register with HMRC. The TRS began accepting registrations from non-taxable trusts in September 2021, with an initial deadline of 10 March 2022. Due to delays in getting the TRS prepared, this deadline was later amended to 1 September 2022.

Rules relating to non-taxable trusts

The September 2022 deadline applies to all trusts that existed on or after 6 October 2020 – even if they are now closed. Following this deadline, all new trusts (and any changes to the details of existing trusts) must be registered within 90 days. In order to not penalise trusts set up close to the September 2022 deadline, however, the 90-day rule will also apply to trusts set up on or after 2 June 2022.

Which non-taxable trusts are exempt?

There are some trusts that are exempt from registration unless they pay UK tax. Some examples include trusts used to hold money or assets of a UK-registered pension scheme, trusts holding life insurance and other policies that pay out upon a person’s death, charitable trusts and will trusts.

We understand that the rules relating to trusts are complex, so please don’t hesitate to contact us if you are unsure.

Author: Richmond House Wealth Management

The sun doesn’t go down on UK Venture Capitals Markets

It is safe to say that the ‘mini-budget’ statement of 23 September was not well received, causing an unprecedent devaluation of sterling and decreasing investor confidence in the government. Amongst a host of measures there was a silver lining, confirmed by former Chancellor Kwarteng, for the ongoing support of Enterprise Investment Schemes, Venture Capital Trusts and Seed Enterprise Investment Schemes, by extending them beyond the 2025 ‘Sunset Clause’.

In this article I will outline the importance of these types of investments, why the ‘Sunset Clause’ was removed and the opportunity this brings.

Now, more than ever, what the UK economy needs is the capital and operational expertise that businesses require to grow and succeed, creating jobs, driving economic growth, and building stronger, more sustainable companies.

That is precisely the job of venture capital firms through Enterprise Investment Schemes, Venture Capital Trusts and Seed Enterprise Investment Schemes. The emphasis is on early-stage growth companies that are crucial for the economy.

Growth in the supply of venture capital in the UK has been heavily influenced by the tax and regulatory regime, by developments in capital markets, and by the industrial environment. Investing into Enterprise Investment Schemes, Venture Capital Trusts and Seed Enterprise Investment Schemes offer an immediate 30% Income Tax relief plus additional tax benefits.

The UK is Europe’s leading centre for venture capital, capturing almost a third of all venture capital investments in Europe during 2020. Upon leaving the EU, the ‘Sunset Clause’ was introduced by the Treasury to reduce the tax efficiency on new investments post 6 April 2025. This clause was requested by the European Union to review the assistance the UK government was providing to UK businesses. The prospect of such a ‘Sunset Clause’ had sparked considerable alarm. Many UK venture capital bodies have raised concern over the closure of the schemes, which they have said would deter investors in young, high-risk startups.

The removal of the ‘Sunset Clause’ provides support not only for investors but also for the entrepreneurs and smaller companies who drive growth in the economy with the significant help these schemes offer. This recognition of the hugely important role they play, allows companies continued access to the all-important finance they need to achieve their goals.

The good news for the individual investor is that the opportunity to invest tax efficiently remains open for business. The generous tax breaks that will now continue, offer a combination of tax-free income, deferral of a previously realised capital gain, a tax-free gain and, of course, an Income Tax liability reducer. These can be particularly attractive to higher earners who face restrictions on pension funding.

References

https://ifamagazine.com/article/huge-boost-to-eis-and-vct-sector-with-the-end-of-the-sunset-clause-and-increases-in-seis-level/

Author: John Diaz, Chartered Independent Financial Planner

Discipline may be the best defence in market downturns

While investing in the stock market is typically a sensible choice for investors seeking long-term growth, sharp drops can still be hard to stomach. Below are some things to keep in mind if a market tumble makes you feel the need to ‘do something.’

Downturns aren’t rare events

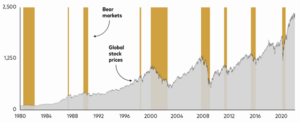

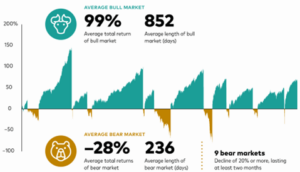

Typical investors, in all markets, will endure many bear markets during their lifetime. A bear market refers to market declines of 20% or more, lasting at least two months. Since 1980 there have been 9 bear markets.

Sources: MSCI World Index from January 1, 1980, through December 31, 1987, and the MSCI AC World Index thereafter.

Although the downturn that began in March 2020 doesn’t meet the definition of a bear market because it lasted less than two months, it has been included in the analysis because of the magnitude of the decline.

Dramatic market losses can sting, but it’s important to keep a long-term perspective and stay invested in order to participate in the recoveries that typically follow. Some bear markets since 1980 have been sharp, but many bull market surges have been even more dramatic, and often longer, leaving investors well compensated over the long term for the risk they took on.

Sources: Vanguard calculations, using the MSCI World Index from January 1, 1980, through December 31, 1987, and the MSCI AC World Index thereafter. Indexed to 100 as of December 31, 1979.

Timing the market is futile

Trying to time the market runs the risk of missing the best-performing days. The best and worst trading days often happen close together and occur irrespective of the overall market performance for the year.

What you can do when volatility hits:

- Tune out the market noise. There’s an old adage about never checking your account when stocks are falling. It’s smart advice. As the graphics above show, making a hasty decision usually results in a mistake.

- Revisit your asset allocation. If market corrections are making you lose sleep, it may be time to revaluate your risk tolerance.

- Stay diversified. A great way to insulate your portfolio is to be invested across a wide range of shares, bonds and international markets as part of an asset allocation plan that makes sense for your risk tolerance and goals.

Following these simple steps can help you avoid overreacting to short-term downturns and position you for long-term success.

Source: Vanguard Asset Management, Limited – Discipline may be the best defence in market downturns

Author: Beth Mills, Will Writer and Trainee Financial Planner

bmills@richmondhousewm.co.uk

Tel: 01438 342430

Is it time to consider annuities as part of a retirement solution again?

An annuity is a product that turns an individual’s pension savings into an income for life. Many more people will now be looking at using some of their retirement cash to buy one.

Increased rates

Latest figures show that annuity rates have leapt by 44% in the space of a year and are now at their highest levels since early 2009. Someone aged 65 with a £100,000 pension pot could now get an annuity income of £7,191 a year – up from £4,989 in October last year1.

It has long been the case that one way to use your pension pot is to buy an annuity. This gives you a regular guaranteed retirement income for the rest of your life or for a fixed term.

However, for a long time, annuities were viewed as poor value. Demand for them fell off a cliff after the government introduced a range of ‘pension freedoms’ in 2015 that meant people no longer had to take one out. Low interest rates and increased life expectancy also meant that annuity rates tumbled.

The financial and economic backdrop is now very different. When interest rates rise, so do annuity rates. They have been turbocharged by soaring long-term gilt yields (the interest rate on UK government bonds). Being able to guarantee at least a part of your income in retirement is invaluable.

Meanwhile, one of the sector’s big names, Standard Life, said this month that it is ‘seeing renewed interest in annuities given the income security they offer in the current market environment’.

A choice of annuity types

Once you buy an annuity, you can’t normally change your mind, so you may want to seek some independent advice as there are lots of different types.

For example, do you want your annuity income to stay the same or increase each year? Do you want a single-life annuity or one that provides an income for your spouse, civil partner or other dependant after you die (a joint-life annuity)? If you have a medical condition, are overweight or smoke, you might be able to get a higher income by opting for an enhanced or impaired life annuity.

The key point is that an annuity does not have to be bought at the date of retirement – rates are increasingly attractive the later you buy.

A sensible approach

Many retirees are dissuaded by the fact that once you’ve bought an annuity, the rate is locked in forever. Those sitting on lower rates purchased in previous years can’t benefit from more recent rises. However, it’s always worth bearing in mind that you don’t need to lock into an annuity with your entire pension pot all at once. One sensible approach is to do it with tranches of your pension in stages, securing income to meet your needs, as and when it makes sense for you. This gives you the opportunity to secure higher rates as you get older or to qualify for an enhanced annuity if you develop a medical condition at a later point, boosting your income again.

Many more people will now be looking at using some of their pension fund to buy an annuity while leaving the remainder invested and taking variable income or lump sums through drawdown.

It is vital to remember that you don’t have to take an annuity offered by your existing pension firm – you are free to shop around and buy one from any provider, probably resulting in a better deal by doing so. The difference between the best and worst providers can be up to 15% a year extra income once medical conditions or lifestyle factors are taken into account.

1 Hargreaves Lansdown

Author: John Merrifield, Chartered Financial Planner

jmerrifield@richmondhousewm.co.uk